TLDR: On-chain interest rates in digital assets are mainly floating in nature. For Ethereum fixed income products to expand beyond this, we need a benchmark that can be used across different maturities. Treehouse has developed a new primitive called Decentralized Offered Rates (DOR), a consensus mechanism that incentivizes an economy of stakeholders to build accurate reference rates.

To Yield, or Not to Yield

In our previous blog, we talked about how tETH is fundamental to establishing Ethereum’s “risk-free” rate. Without it, or without the convergence of ETH rates, fixed income in the space will likely take many more years to mature.

Branching Out 5 now delves into Treehouse’s next phase: why the digital asset ecosystem requires the Treehouse Ethereum Staking Rate (TESR) curve, and how tETH plays a role in the functioning of the Treehouse Protocol.

Up first, what is the TESR Curve? And why do we need one?

The TESR Curve

To fully appreciate the significance of the Treehouse Ethereum Staking Rate (TESR) Curve, it is helpful to first consider its application in traditional finance. In traditional finance, interest rates are often used to quantify a counterparty’s credit risk. Lenders can expect an interest rate to be paid out by borrowers during the term of the contract and full principal repayment at maturity for the risk taken in lending money.

These rates are often priced on top of reference rates, a cornerstone of financial markets, as discussed in the previous blogs!

Depending on the nature of the instrument, interest payments can either be fixed or floating.

Traditional fixed interest rate loan example: If John takes a fixed interest loan of 5% per year on a capital of $1,000 borrowed over a period of 5 years, he can expect to pay $50 ($1000 * 5%) every year on his loan.

But how does one derive this 5% figure?

If the USD 5-year “risk-free” rate (U.S. Treasury bond) is 3% at the start of the loan; we know that John’s credit risk is valued such that people are willing to lend money to him as long as they are paid an additional 2% more than the “risk-free” rate.

Regardless of market conditions, John will always be required to pay 5% in interest throughout the life of the loan, hence the term fixed!

Now, let’s try to make sense of floating rate instruments in the Ethereum Proof-of-Stake (PoS) context.

Ethereum rates today, a floating rate example: As established in our previous blog, the Ethereum PoS rate is a good proxy for the Ethereum “risk-free” rate. Ethereum PoS rate, however, happens to be floating. To explain what floating means, let’s use John’s example again.

Should John borrow money with a floating rate, the investor will receive a variable return instead of the 5% fixed. Furthermore, the exact interest payout will only be determined at the point of settlement, likely with a spread of 2% above the 5 year “risk-free” rate on that particular day. Say if the 5 year “risk-free rate” is 10% at year two, John would likely need to pay an interest of 12% (10% “risk-free” + 2% spread).

Therein lies the first issue with the PoS rate: while the U.S. government bond market has a full yield curve, with bonds active up to 30-year maturities to reference, Ethereum’s PoS are only floating, only existing at the spot time frame. This means that Ethereum’s PoS rate only reflects the current “risk-free” rate on a block frequency basis.

Much like the yield curves in traditional finance, the TESR Curve serves as a foundational tool for the ETH digital asset markets. The TESR Curve, thus provides a graphical depiction of the expected yields on Ethereum when staked over varying periods, crucial for evaluating investment risks and opportunities in DeFi. If we are to develop fixed income products in digital assets beyond simple variable agreements, we will need a reference across different maturities of borrowing and lending over time.

A[DOR]ning the Digital Asset Space

Okay… But how do we derive the TESR Curve?

In traditional finance, the market often relies on a panel of experts from major banks for their consensus on reference rates such as the London InterBank Offered Rate (LIBOR). LIBOR however was defunct in 2023, as there were problems with accuracy and collusion over the years (jump to One Rate to Rule Them All to have a more detailed explanation).

Because of these issues, USD contracts today mainly reference the new and improved Secured Overnight Financing Rate (SOFR), which uses historical data of actual repo transactions. Both curves were / are extremely important in financial markets, serving as a reference rate for a wide range of financial products, including mortgages and derivatives, amounting to hundreds of trillions of dollars over the years.

But the newly created SOFR isn’t perfect either, it’s ultimately a reference rate that is issued by a centralized authority that may or may not be trustworthy. Thankfully, this is exactly what blockchain technology is best at solving.

The Treehouse Protocol

Introducing the Treehouse Protocol, a consensus mechanism for benchmark rate setting that powers Decentralized Offered Rates (DOR). DOR are reference rate curves that investors and platforms can use to build interest rate financial products (i.e. interest-rate swaps, swaptions, callable notes, etc).

As a blueprint, Treehouse will act as the Operator of the first DOR, relying on a group of expert Panelists we’ve partnered with to establish consensus for the TESR reference rate.

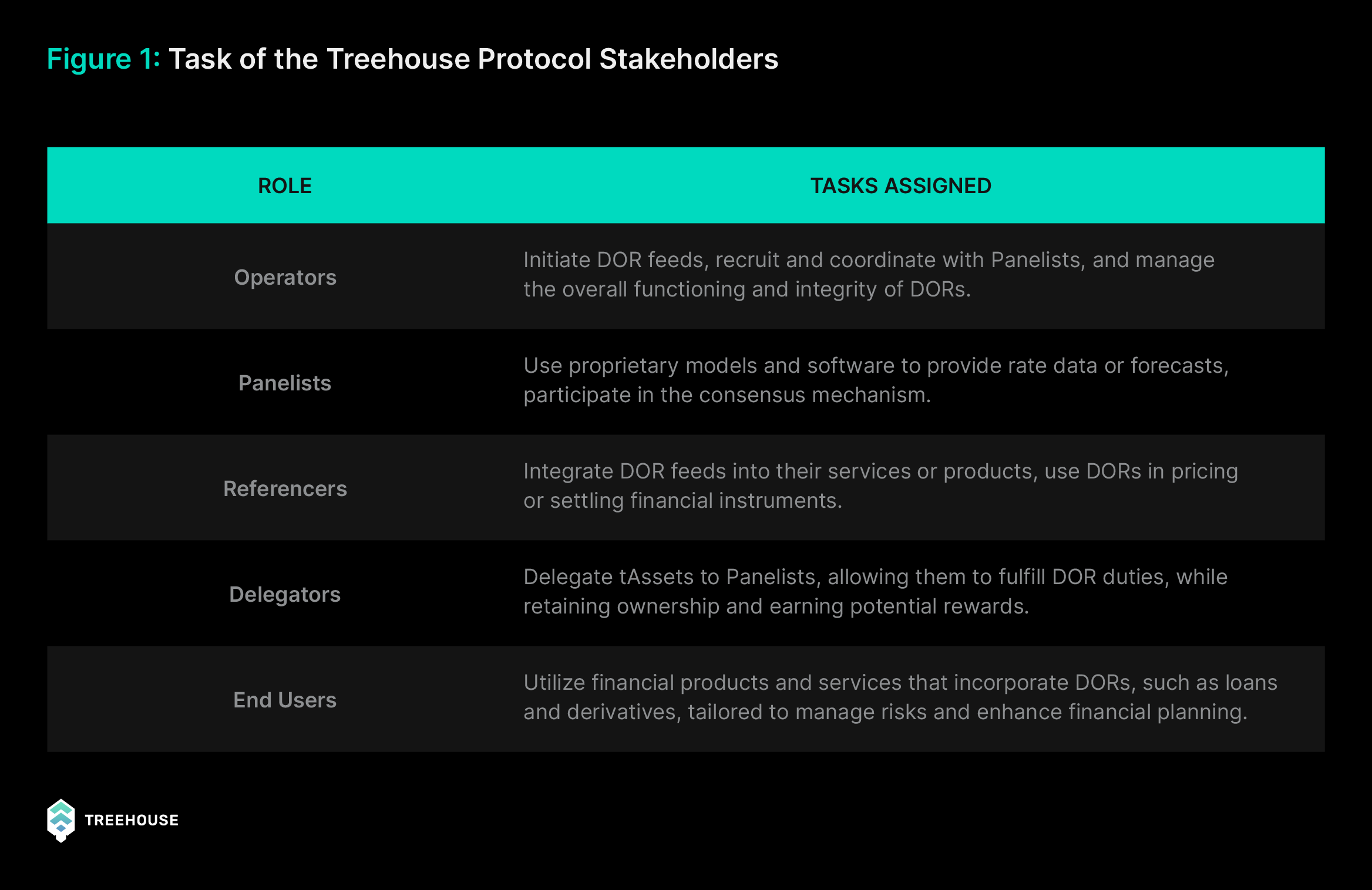

Without further ado, let’s introduce the stakeholders that will be helping us do this:

- Operators: Initiators of DOR feeds that help to maintain its integrity and success. In the case of the TESR Curve, this would be Treehouse!

- Panelists: Entities (i.e. market-makers, Oracles, staking houses, exchanges) that are equipped with proprietary models and Treehouse DOR software to provide interest rate data or forecasts.

- Delegation: The process where stakeholders of Treehouse can delegate assets to Panelists to fulfill DOR duties on their behalf, potentially earning rewards.

- Referencers: Entities (i.e. protocols, exchanges) that integrate DOR feeds into their own interest rate related services or products.

- End Users: Users of the underlying interest rate related services or products developed by Referencers.

Together, these roles create and sustain the DOR ecosystem by ensuring its development, application, and continual adjustment based on market conditions.

[DOR]-Re-Mi

To make things easier to understand, here’s an theatric analogy of the Treehouse stakeholders:

1. Operators are like the theater directors, setting the stage, coordinating the actors, and overseeing the entire production. They set the tone and direction for the show, much like setting the parameters for the DOR.

2. Panelists are akin to the scriptwriters, devising the storyline – in this case, the forecasted rates. Their scripts (predictions) are crucial for the play (financial ecosystem) to be believable and engaging.

3. Delegators resemble the investors in the production. They fund the play, hoping it will be a hit. Their support allows the scriptwriters (panelists) to develop and refine the script (rate predictions).

4. Referencers are the critics and promoters, publicizing the play and providing an accessible interpretation (benchmarks) for the audience. They rely on the script’s quality (accuracy of the rates) to attract the public and endorse the play.

5. End Users are the audience, buying tickets and filling the seats. Their demand for an entertaining evening reflects the demand within the financial system for reliable and functional products tied to the DOR.

In each step of the production, every role is interconnected: without a director’s (operator’s) vision, there’s no structure; without a scriptwriter’s (panelists) story, there’s nothing to perform; without investors (delegators), there’s no funding for the show; without critics and promoters (referencers), there’s no buzz to draw the public; and without an audience (end users), there’s no one to appreciate and sustain the play.

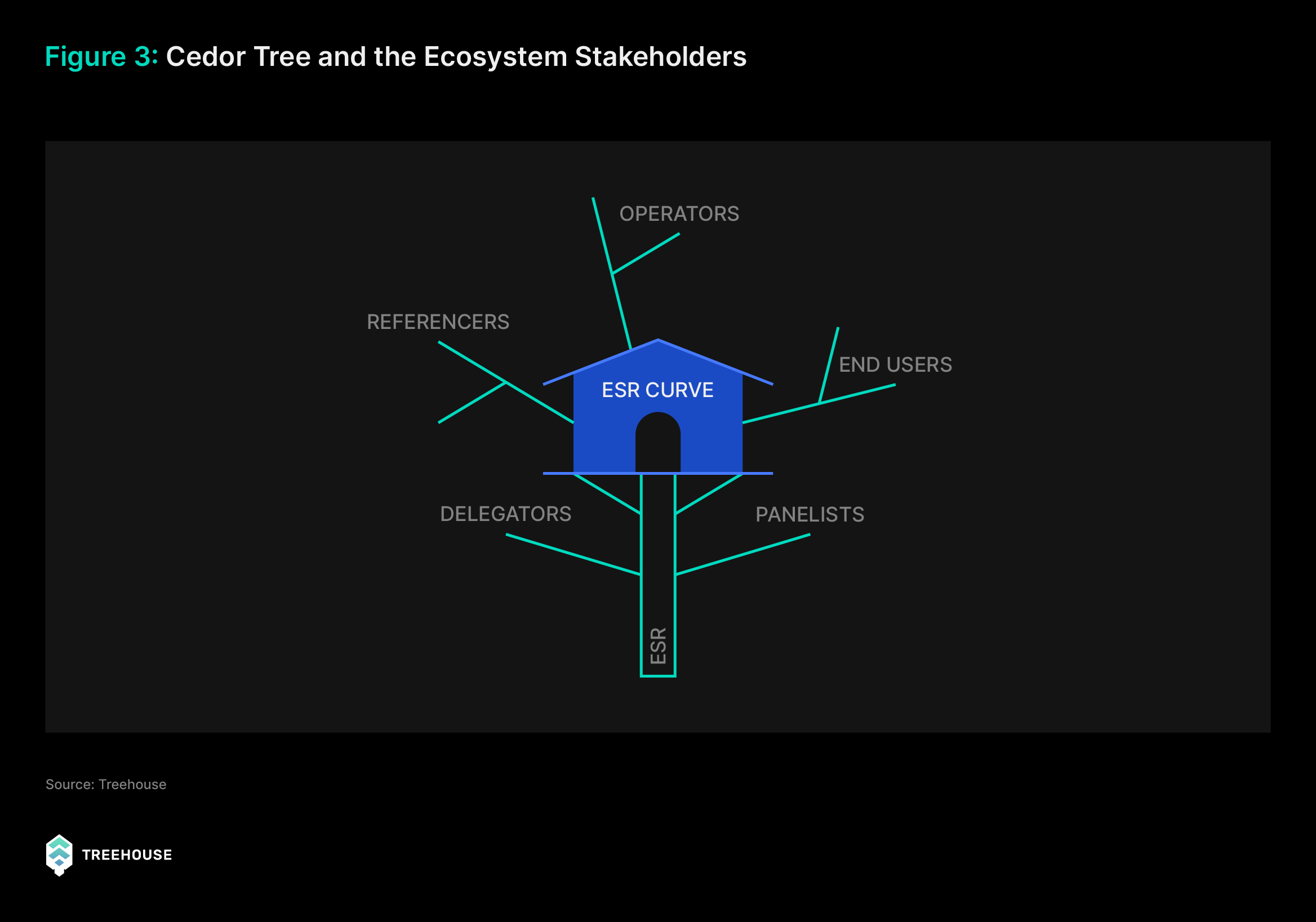

Atop The Ce[DOR] Tree

The process and participants involved in building DOR is similar to building a treehouse atop the cedar tree.

| How does tETH fit into all this? tETH reflects the performance and yield of staked assets such as Ethereum. When the yield of tETH closely reflects the PoS yield, it is an indicator that the ETH borrowing and lending market is efficient. Additionally, holders of tETH help secure the cryptoeconomic security of the Treehouse AVS, potentially earning them more rewards! |

Out the [DOR]

In a nutshell, stakeholders in the digital asset space can wonder no more about the future of fixed income. Moving forward, we invite you to join us here at Treehouse in shaping the development of DOR to forever transform financial markets.

In our next blog, Branching Out 6, we’ll explore a myriad of innovative applications for DOR. Stay tuned and see you there!

For readers interested in a more advanced reading on fixed income and Treehouse, jump to One Rate to Rule Them All.

FAQ

What is the DOR consensus mechanism?

The DOR consensus mechanism establishes reliable benchmark interest rates through an economy of stakeholders.

What is DOR?

DOR, or Decentralized Offered Rates, are reference yield curves established through a consensus mechanism administered by the Treehouse Protocol. They serve as reference rates for fixed income products.

What is the TESR Curve?

The TESR Curve, or Treehouse Ethereum Staking Rate Curve, is Treehouse’s proposed benchmark for Ethereum’s “risk-free” rate across different maturities.

Why do we need the TESR Curve?

The TESR Curve provides a reference for ETH fixed income products by reflecting the current “risk-free” rate for Ethereum.

How does tETH help with forming this rate?

tETH reflects the performance of staked assets like Ethereum and provides essential data for establishing the TESR Curve. It also helps secure the cryptoeconomic security of the Treehouse AVS.