TLDR: tETH is a liquid staking token (LST) that converges the fragmented on-chain ETH interest rates market. tETH facilitates efficient market solutions by leveraging discrepancies in lending and staking rates to maximize user returns. tETH is also foundational to establishing the Treehouse Protocol.

Introduction

In our previous blog, we used apples as a metaphor to describe fixed income rewards such as the yield on staked Ether. Continuing with this theme, we’ll explore how tETH operates, this time, likening it to a state-of-the-art robot.

Imagine owning an apple tree (Ether) in a futuristic world: As a farmer, you also own a robot that automatically harvest apples for you (Liquid Staking Tokens). The robot has been great, but a new and improved robot just came out at the store that can both harvest apples while doing other tasks for you (Liquid Staking 2.0). After carefully considering, you decide to buy one.

Now, you get to enjoy the fruits of your robot’s labor from the comfort of your home while being able to use it for other things!

tETH – the Autonomous Efficient Market Solution

tETH is pretty much this new apple picking robot—part harvester, part savvy trader. This terminator of a robot not only plucks apples from your tree (Ether) but also zips off to the inefficient apples market (discussed in our previous blog) to play the arbitrage game.

It sells your apples at market prices and scoops up underpriced ones to maximize your apple haul. But that’s not all—this crafty robot also forages for berries along its journeys, piling them into your basket. Woohoo, it’s time to make a fruit bowl!

Under the hood, tETH takes in your native ETH or LST (apple trees), and gives you the return from arbitraging lending and staking rate across platforms. Holders of tETH also earn rewards during the points campaign (berries) for when Treehouse Protocol as a whole goes live. Now that’s efficiency.

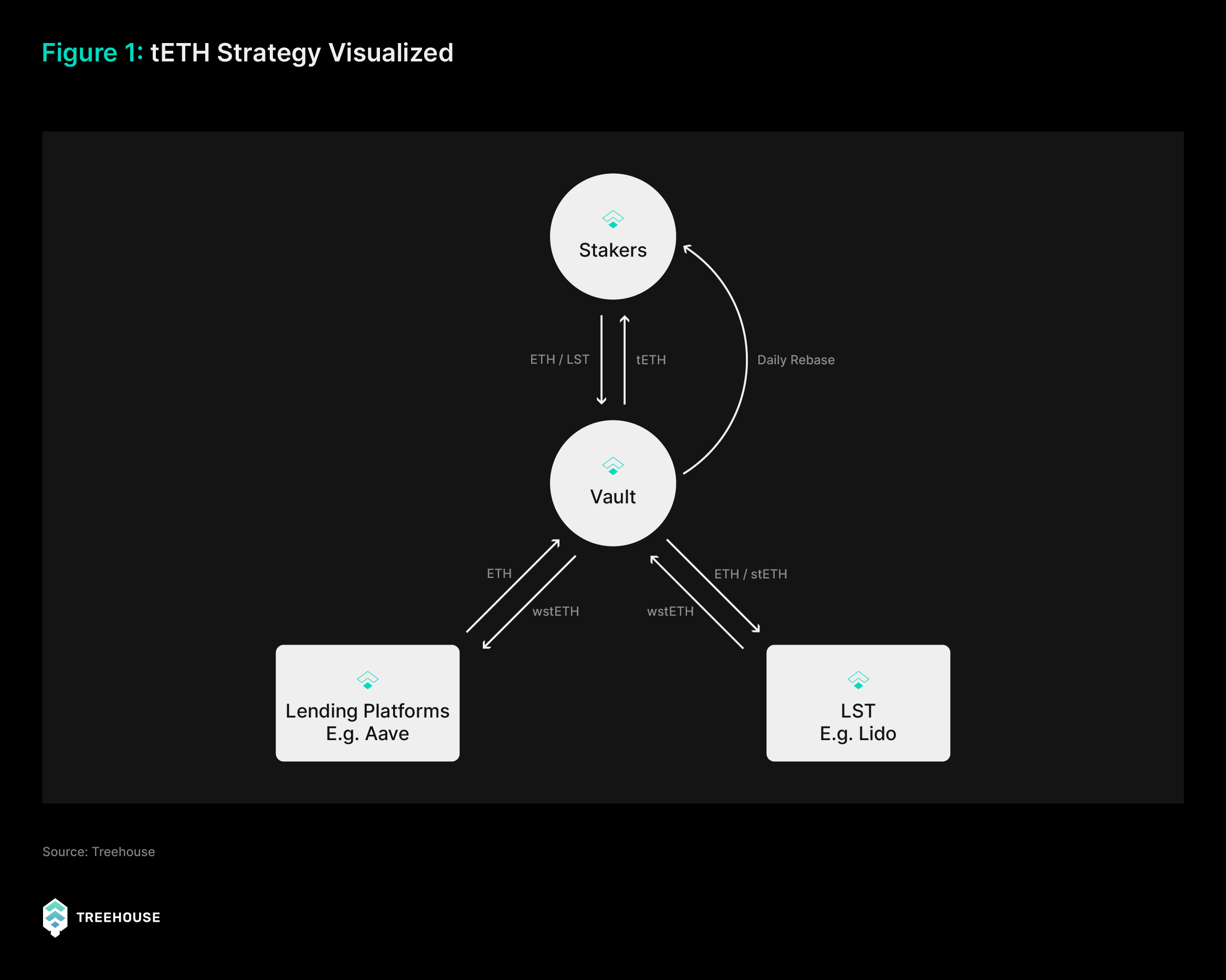

Here’s a diagram of how it works:

But what is this “convergence” we keep talking about?

Convergence, in the context of tETH, refers to the balancing act between borrowing and lending rates in DeFi. As more ETH is borrowed, interest rates climb, prompting adjustments that draw the borrowing and lending rates closer to the Ethereum Staking Rate.

This not only keeps the market stable, but also creates a fertile ground for developing fixed-income derivatives like interest rate swaps and options (oranges, bananas, etc).

With borrowing and lending rates closely aligned and stabilized around the Ethereum Staking Rate, predictability increases, crucial for financial instruments that depend on fixed or predictable returns. This also allows developers to craft sophisticated products tailored to risk management.

How is tETH different?

What ultimately sets tETH apart is that it allows you to play a direct role in shaping the building blocks of the Treehouse Protocol. Think of this: to build a house, you first need to lay a good foundation. tETH does precisely that, specifically:

1. Democratizing access to fixed income arbitrage: tETH allows users to partake in strategies previously only available to institutional investors, passing yield to holders.

2. Ensuring on-chain interest rate efficiency: in order for fixed income in digital assets to develop, the market needs to be efficient, a capital intensive endeavor. Holders of tETH actively shape on-chain markets by converging rates to Ethereum’s “risk-free” rate.

3. Powers Decentralized Offer Rates (DOR): by holding tETH, you’re enhancing the cryptoeconomic security of the Treehouse Protocol, a new primitive for benchmark rate setting.

More of this in our next blog, Branching Out 5!

For readers interested in a more advanced reading on fixed income and Treehouse, jump to One Rate to Rule Them All.

FAQ

What is tETH?

tETH is a liquid staking token (LST) designed to align and optimize fragmented on-chain Ethereum interest rates. It maximizes user returns by leveraging discrepancies in lending and staking rates.

How does tETH work?

tETH operates like a trading bot that trades market inefficient products to increase returns. It restakes ETH or LST and rewards holders through rate arbitrage and other incentives.

What is the benefit of using tETH?

Using tETH allows you to earn efficient returns while also benefiting from potential bonuses during Treehouse Protocol’s rewards campaign. It democratizes access to arbitrage strategies and helps align borrowing and lending rates.

What does convergence mean in the context of tETH?

Convergence refers to the process where borrowing and lending rates in DeFi adjust to align more closely, stabilizing the market and laying foundations for fixed income products in DeFi.

How is tETH different from other liquid staking tokens (LST)?

tETH stands out by enabling users to participate directly in Treehouse Protocol: democratizing access to fixed-income arbitrage, ensuring on-chain interest rate efficiency, and supporting Decentralized Offered Rates (DOR).

What is the goal of tETH within Treehouse Protocol?

tETH aims to build a solid foundation for Treehouse Protocol by democratizing access to arbitrage, enhancing rate efficiency, and extending cryptoeconomic security to the Treehouse Actively Validated Service (AVS).