TL;DR: At Treehouse, we’ve built strong safeguards for tETH’s strategy to handle the markets’ ups and downs. We actively monitor parameters and have an insurance fund to act as a safety net!

Welcome back! We hope you are well acquainted with tETH by now. In this blog, we will discuss some of the potential risks that our protocol may encounter in the name of transparency.

Yes, Treehouse is susceptible to storms. The truth is – nothing is “risk-free.” Any protocol failing to share these disclaimers with you upfront is probably sus!

Specifically, we’ll be sharing some risk scenarios even if the chances of them happening are extremely low. Ultimately, tETH’s strategy is designed with you in mind, with layers of safeguards to minimize risks.

Let’s examine how we manage some of these risks and keep our strategy secure, even when the skies are cloudy.

Depegging and Liquidations

As with any protocol involving borrowing and lending, the specter of liquidation is always possible. tETH’s strategy, however, only uses one round of rehypothecation, with parameters built in to ensure more than enough buffer room to prevent liquidation. The protocol also only sticks to pegged assets for collateral and loans, ensuring that the risk of positions getting swept away is low. That said, there’s still always a sliver of risk.

If the LST used as collateral drifts too far from ETH, for instance, it could trigger a sticky situation. In fact, some of the factors driving them could be out of our control, e.g., if Lido or Aave blows up.

But if the value of LST falls significantly compared to ETH based on parameters that are within our control, there’s no need to scamper down the tree in panic—here are some of our built-in safety measures to minimize liquidation due to depegging:

- Continuous Monitoring: Our system monitors any ETH/LST price action. Any time it dips by more than a specific percentage, we trigger an action plan.

- Automatic Response: If that little dip turns into a more prolonged slide, our system automatically starts to repay loans and unwrap LSTs.

- Strategic Unwinding: We smoothly swap the weakening LST back to sturdy ETH using liquidity pools, making sure we’re always holding the strongest branch.

- Securing Your Fruits: After repaying any borrowed ETH, we pull back any remaining LST, ready to be safely stowed or returned to you.

- Freedom to Withdraw: In the aftermath, users would be able to withdraw their LST stash or keep it with us to see if the branch strengthens again.

Preventing High Interest Rates

Another crucial thing to keep an eye on is the utilization rates of lending platforms, which directly affect our interest rates and potentially make our tETH strategy less fruitful.

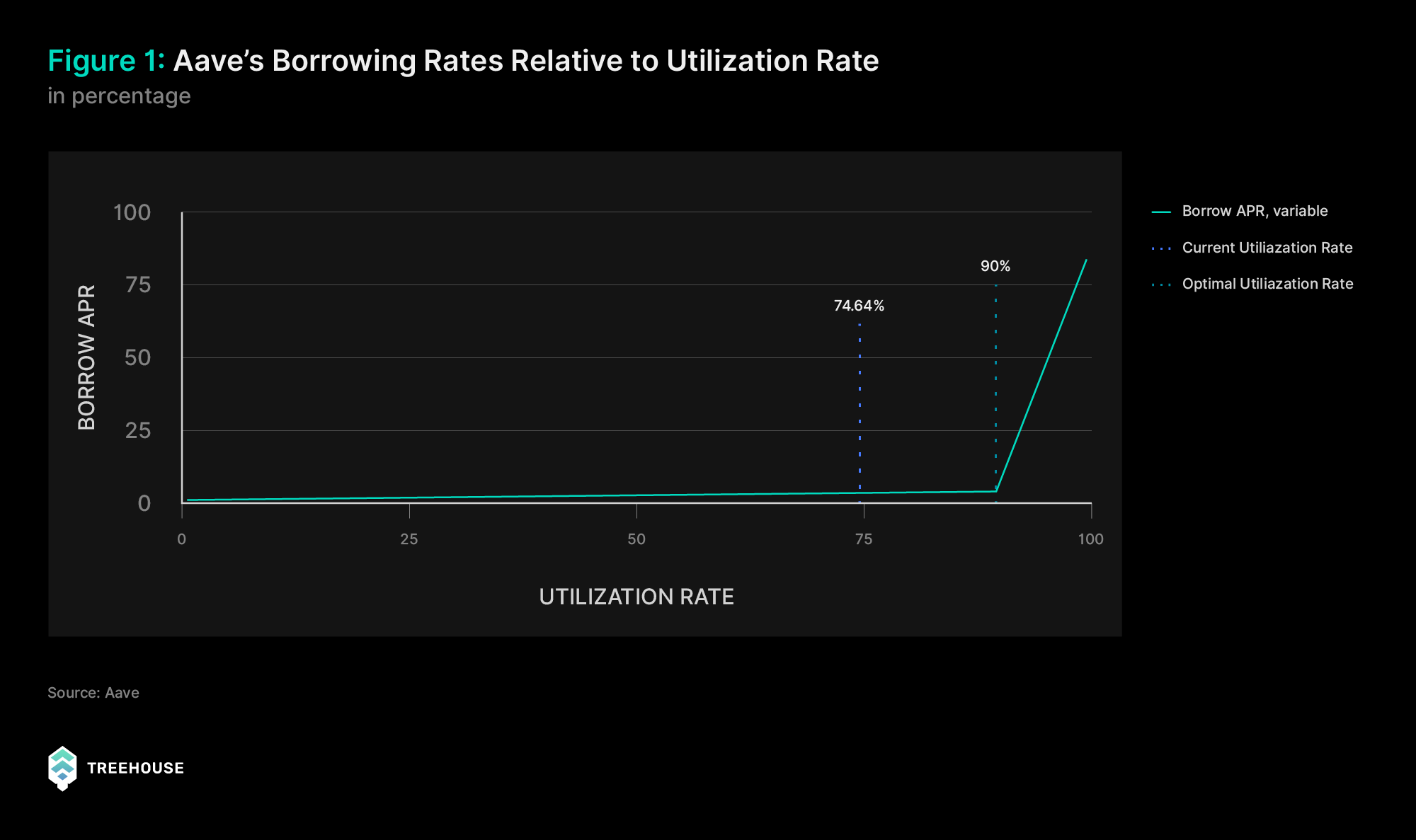

Looking at Aave, for example, when the Utilization Rate is higher than the optimal rate of 90%, the Borrowing Interest Rate skyrockets.

Why? When many people want to borrow ETH and there isn’t enough to go around, it pushes up the interest rates. High interest rates can eat into our profits, making our tETH strategy look less shiny.

Here’s how we plan to manage the interest costs and ensure our strategy stays on the profitable path:

We constantly monitor the utilization rates of ETH borrowing to ensure that our strategy remains sustainable, even when the winds of market demand blow strongly. Here’s how we do it:

When Utilization Rates climb higher than our comfort zone, we don’t just sit there like a fallen log. We leap into action, unwinding the necessary amount of LST to repay our ETH loan and bring the utilization back within our bounds. This dynamic adjustment keeps our borrowing costs in check and ensures our strategy remains nimble and efficient.

- Upper Bound of Internal Utilization Rate: Think of this as our early warning system. If it reaches this, we will adjust our strategy to bring things back to a more affordable level.

- Lower Bound of Internal Utilization Rate: This is our goal for the least amount of ETH we want that is being borrowed on the lending platforms.

Despite all these, there may still be rare moments when our strategy might not perform as expected and becomes momentarily unprofitable. In these instances, the Treehouse Insurance Fund is ready to cover shortfalls. With this safety net in place, you can invest with more confidence!

For more information on tETH’s risks, refer to the Risk section of our Docs here!

FAQ

How does Treehouse manage the risk of liquidation?

We employ a single round of rehypothecation and use pegged assets to stabilize our positions. Our systems monitor the market continuously, especially the price relation between LST and ETH.

What happens if the utilization rates on lending platforms become too high?

We actively monitor these rates and respond by adjusting our borrowing to maintain costs within a sustainable range. This may involve unwinding positions by converting LST to ETH to repay loans, ensuring the rates stay within our defined upper and lower bounds.

What are the upper and lower bounds of the internal utilization rate?

Upper Bound: This is set as a precaution to prevent high borrowing costs. If utilization reaches this level, we adjust our strategy to reduce costs.

Lower Bound: This marks the minimum level of ETH borrowing we aim to maintain on the platform, balancing cost efficiency with liquidity availability.