TLDR: Fragmented rates across DeFi pose challenges for “risk-free” rates to be effectively used. These market inefficiencies however create opportunities for arbitrage. tETH, Treehouse’s first application, was built to foster market efficiency within the ETH lending market.

Introduction

In this blog, we’ll explore fragmented rates in DeFi and how tETH aims to resolve this problem.

Let’s first understand interest rates “fragmentation,” but in the simpler context of apples!

Imagine being at a fruit market: you come across some branded apples and buy them for a “discounted” price of $10. Later, you walk by another shop to find the exact same apples selling for $8.

Disappointed, you eat your apples but sulk about it. The next day, you check the price of apples at the same shop to find them selling for $8.5, while the store next to it is selling them for $9.5. Frustrated, you walk away and decide not to eat apples today.

Pause. What does the above scenario tell us about the apple markets?

The difference in apple pricing across stores highlights a lack of consensus regarding the market price of apples, making it difficult for consumers without knowledge and access to know the market clearing price. Beyond that, it shows that apple merchants have not come to agreement on how apples should be priced, leading them to charge based on their gut feeling.

Inconsistent Rates in Digital Assets

The borrowing and lending interest rate markets in digital assets today resembles the scenario painted above. Ideally, consensus would look like everyone buying and selling apples—or in digital assets terms, lending and borrowing—at the same price. However, across various lending platforms like Aave and Spark, borrowing and staking rates differ significantly today.

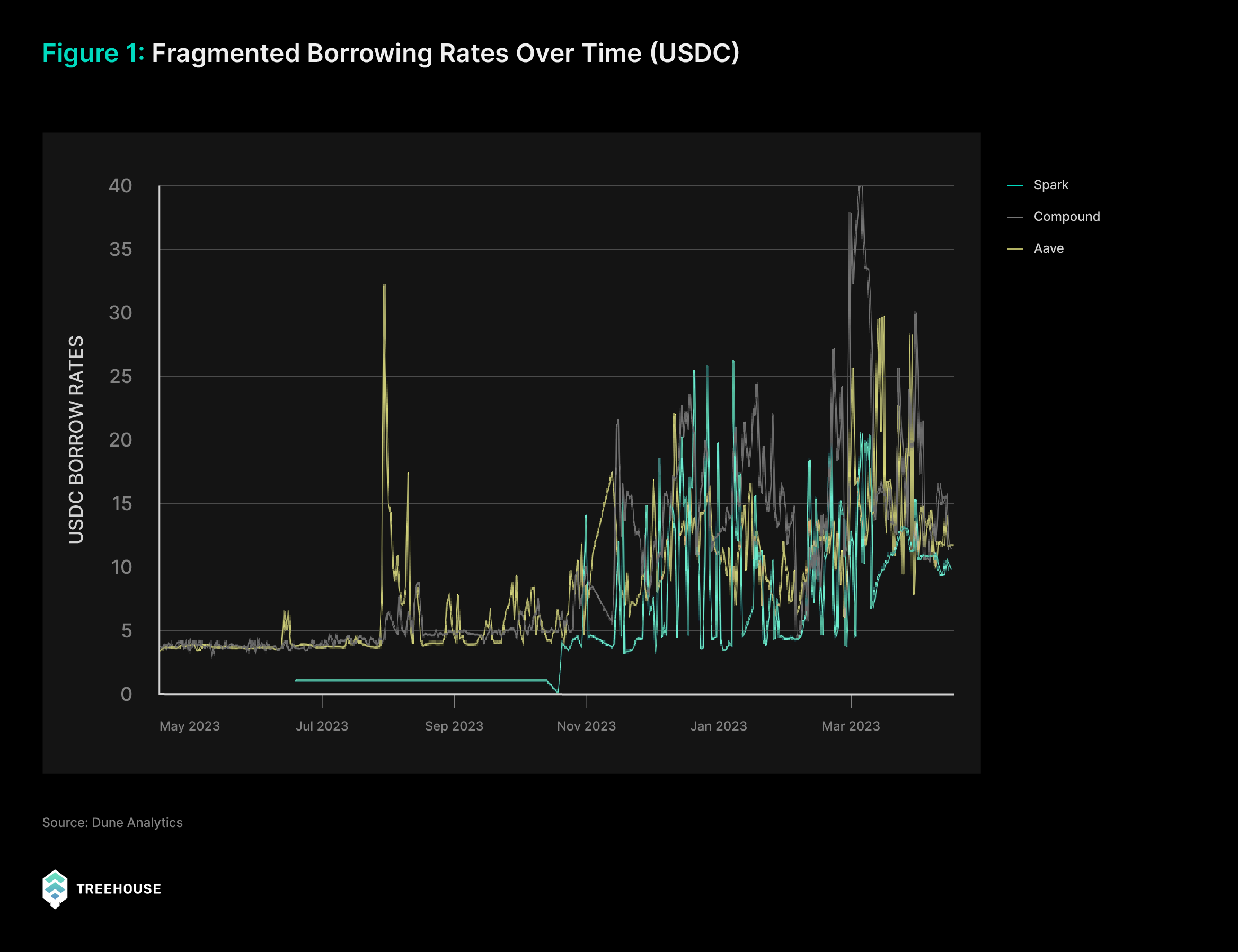

Zoom into the graph below, how would anyone confidently know where is the best price to borrow USDC if the rate is always fluctuating wildly? This inconsistency highlights a clear absence of consensus in the market for the cost to borrow and lend, not just in USDC, but across all assets.

The Arbitrage Opportunity

The good news however is that you’re a smart trader, and you recognize an opportunity here as a neon green sign lights up at a neighboring store: “buying apples for $11”.

Hmm, why not buy up all the apples in the previous stores and sell them at a higher price? By doing this, you’ll also help keep the apple market efficient. Neat!

As explained in our last blog, the Ethereum Staking Rate is essentially Ethereum’s version of a “risk-free” rate. It’s like knowing the benchmark or market consensus price at which you can always sell apples.

With this, Treehouse has come up with a simple strategy for the ETH market: borrowing Ethereum at a lower rate (akin to buying apples at a low price) and then staking it to earn a higher return (selling those apples at a higher price, but safely).

The even better news is that utilizing this strategy influences interest rates on lending platforms, effectively converging these rates towards the market clearing staking rate, the theoretical “risk-free” rate. This convergence helps enhance market confidence and provide return predictability, similar to setting a standard for pricing apples.

As a user, one just needs to hold tETH to participate in Treehouse’s push towards ETH market convergence. By doing so, you’re helping provide the needed capital to keep interest rates across multiple platforms efficient. More on that in our upcoming blog, Branching Out 4, where we’ll dive into the mechanisms of how tETH works!

For readers interested in a more advanced reading on fixed income and Treehouse, jump to One Rate to Rule Them All.

FAQ

What is rate fragmentation in DeFi?

Rate fragmentation refers to differing rates (in borrowing and lending cost) across decentralized finance platforms for the same asset. This inconsistency makes it challenging to identify the market clearing rate.

How does fragmentation affect me?

Fragmentation creates confusion, similar to how different prices for the same product in various stores can mislead buyers.

What is arbitrage?

Arbitrage involves simultaneous taking on two sides of the same trade, often by buying low and selling high, due to price differences across platforms. In tETH’s case, the protocol borrows ETH at a lower rate than the yield made from staking ETH in the Proof-of-Stake (PoS) mechanism.

Why do rates need to be converged?

Rate convergence enhances market confidence and predictability, establishing a fair and consistent environment for participants. Rates need to be converged for Decentralized Offered Rates (DOR) to work. More on that in the next few blogs!