TLDR: Fixed income stands as one of the largest asset classes in traditional finance. As the blockchain space evolves, demand for fixed income investments will continue to grow. However, current implementations of fixed income in digital assets are limited, facing challenges such as interest rate fragmentation. Treehouse is solving this by pioneering the development of a decentralized fixed income layer for benchmark rate setting.

Good Ol’ Toyotas

Think of that trusty old Toyota Corolla: it might not grab anyone’s attention, but it’s dependable and the go-to choice for individuals seeking a safe and predictable journey. Across all the asset classes in traditional finance, fixed income can be characterized as the Toyota of the investment world. As the umbrella that houses financial instruments that pay out interest reliably, it’s just the kind of investment that might make your grandma smile.

Now, I know what you might be thinking—this is crypto, who wants a Toyota when you could have a Lambo? We’re all about “wen Lambo” today and the idea of settling for anything less might not be immediately appealing. But let’s shift gears for a moment.

Believe it or not, there’s a growing crowd in digital assets that want products that are less-flashy and more predictable. With crypto becoming more mainstream, particularly with the pick-up in institutional interest, demand for fixed income products is revving up fast. Think back three years ago—did anyone really expect Bitcoin ETFs to become a reality? Clearly, the digital assets landscape is evolving faster than anticipated. So if you’re only ever focused on high-flying returns, it might be time to do some rethinking to get ahead of the curve.

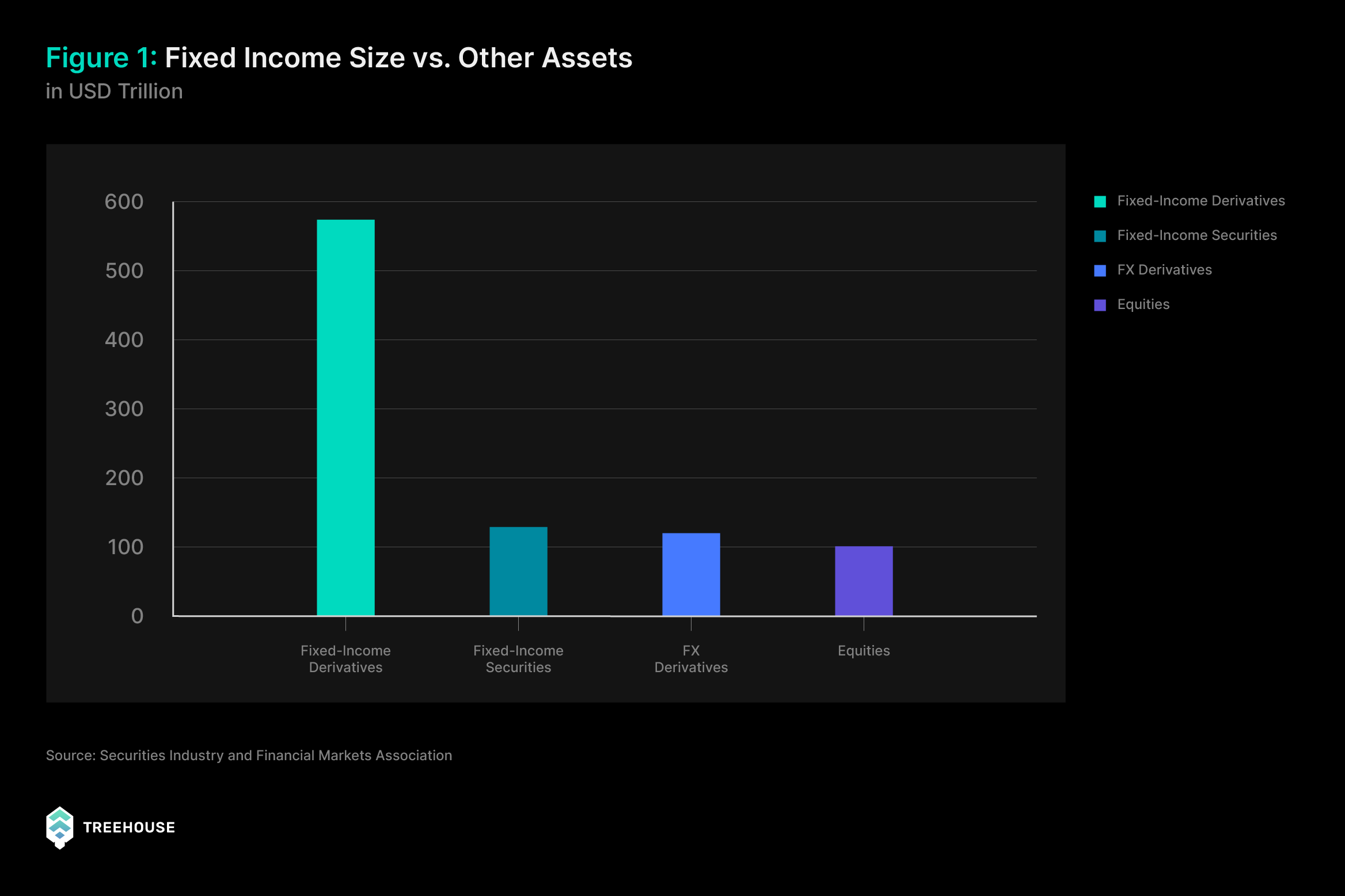

Now, with most derivatives like options and futures already making their way into digital assets, it wouldn’t be outlandish to think that fixed income is next in line. To put things into perspective, the global fixed income market is worth a staggering $600 trillion. Compare this to equities (the asset class housing your favorite Gamestop and/or Tesla stock), fixed income is nearly 5 times larger! Of all the derivatives across asset classes, fixed income comprises nearly 90% of the universe of instruments. That mortgage, bank deposit, money you lent your friend, all fall under fixed income. This is exactly why we believe fixed income will make waves in digital assets sooner than you think.

But if it’s so clear and obvious, why hasn’t fixed income taken off in digital assets yet? Let’s find out…

Traffic Update

Just like how concept cars are full of potential, excitement, and vision—the reality, however, is that they are typically years away from being production-ready. The analogy holds true for crypto fixed income today. Specifically, digital asset fixed income products have not taken off because:

1. Market Immaturity: The digital assets market is volatile and still finding its footing. Fixed income needs a stable market environment to thrive or, at the very least, a reliable benchmark. Currently, there’s massive mispricing where identical items can drastically differ in price.

2. Complexity: There is a lot under the fixed income hood. Translating traditional finance mechanisms into decentralized and automated systems may not be as straightforward as we think. Retail has been a driving force of early blockchain innovations, and while most are familiar with concepts like equity, fixed income is harder to grasp and has historically been an institutional game.

3. Missing Infrastructure: There is a lack of infrastructure for digital asset fixed income products. This was the same problem fixed income products faced when starting off in traditional finance, where the asset class comparatively took much longer versus others to develop into its current state, needing infrastructure and conventions to be put in place.

Current Products

Yes, fixed income in digital assets is still in its early stages, but it doesn’t mean that fixed income products don’t exist. Some of the largest protocols today like Aave and Compound are fixed income in nature.

However, the reality of these platforms is that they are extremely limited in product offerings with most related to simple over-collateralized lending where smart contracts act as automated clearing houses to simple spot transactions between counterparties. This model, while innovative, restricts the flexibility and depth typically associated with mature fixed income markets.

This is the same case in Centralized Finance (CeFi), where fixed income solutions are only touching the surface of the possibilities seen in traditional finance. CeFi fixed income has also faced major setbacks, particularly after the downturns caused by blow ups by borrowing and lending firms like Celsius.

Across the spectrum, fixed income products in Crypto have been unfortunately vanilla nor meaningful enough to become a household staple.

The Treehouse Plan

Here at Treehouse, we’ve laid out a massive plan to tackle the roadblocks mentioned head-on. Our goal is to pave the way for a world where fixed income can become second nature to every crypto user, offering both retail and institutions alternatives to safer and predictable returns.

Starting with Ethereum, we’ll be stitching together borrowing and lending across the digital asset space by introducing a new concept called tETH (more on that in the next few blogs so stay tuned).

Conclusion

With all that boring stuff out of the way, here’s the takeaway from our very first blog: Fixed income in the traditional finance market is enormous. As the digital asset space matures, we expect it to become a fundamental part of the landscape. Treehouse has been working on a solution, but we need your help.

What’s the ticker?! Well, be patient, it’s all in the works. Just know that our team of 50+ has been quietly building a fixed income infrastructure solution for the past 2 years that even your grandma can trust. We’re not just patching up a few potholes; we’re paving a whole new highway. A road that will bring together diverse borrowing rates under one unified roof, enhancing stability to attract not just the adrenaline junkies but also those looking for a safer ride.

Buckle up, you’re in for a hell of a ride! Click here to read Branching Out 2.

For readers interested in a more advanced reading on fixed income and Treehouse, jump to One Rate to Rule Them All.

FAQ

What is fixed income?

Fixed income refers to investments that provide returns in the form of regular interest payments until the investment’s maturity. Common examples include loans and treasury notes.

How does fixed income work in digital assets right now?

In the digital assets space, fixed income is still developing. Unlike traditional markets, where fixed-income instruments offer stable returns backed by entities like governments, digital asset fixed-income products are subject to high volatility and lack a standardized benchmark.

Why is fixed income important in digital assets?

Fixed income in digital assets can attract a broader range of investors by providing more stable investment options compared to the high volatility typically associated with digital assets. This stability can make digital assets more appealing to risk-averse investors.

What challenges do fixed income products face in digital assets?

Challenges include the lack of a universally accepted “risk-free” rate, high volatility, operational risks like smart contract vulnerabilities, and uncertain regulatory environments.

How does Treehouse intend to overcome these challenges?

Treehouse plans to build an efficient market starting with Ethereum, focusing on secure, transparent, and consolidated fixed-income products. This approach aims to minimize volatility and provide a foundation for other fixed-income products to develop.

What’s next for fixed income in digital assets?

The goal for Treehouse is to merge traditional fixed-income principles with decentralized finance innovations, enhancing market efficiency and stability, and potentially democratizing access to stable investment options in the digital asset space.