TL;DR: Forward Rate Agreements (FRAs) are the fundamental building block for the fixed income world. By enabling participants to manage their exposure to anticipated rate changes, FRAs lay the groundwork for developing a broader range of fixed income products.

In our previous article on The Rate Renaissance, we talked about building the next wave of fixed income products in Crypto. In this blog, we shift our focus to one of the most fundamental primitives in the fixed income market: Forward Rate Agreements (FRAs).

WTF is a FRA?

Think of a futures contract like reserving a deal for the future. Today, you can lock in a price for Ethereum to buy or sell it on December 26, 2025—no matter what ETH actually costs by then.

FRAs work the same way, but instead of locking in an asset’s price, you lock in an interest rate. Let’s say the staking rate for ETH is 3.2% today. By entering into a FRA, you can secure that rate for a future date, making your financial planning more predictable.

But how do FRAs work? Let’s understand them from the perspectives of a borrower and a lender—the two counterparties involved in any interest-rate product!

1. FRAs from a Borrowers Perspective

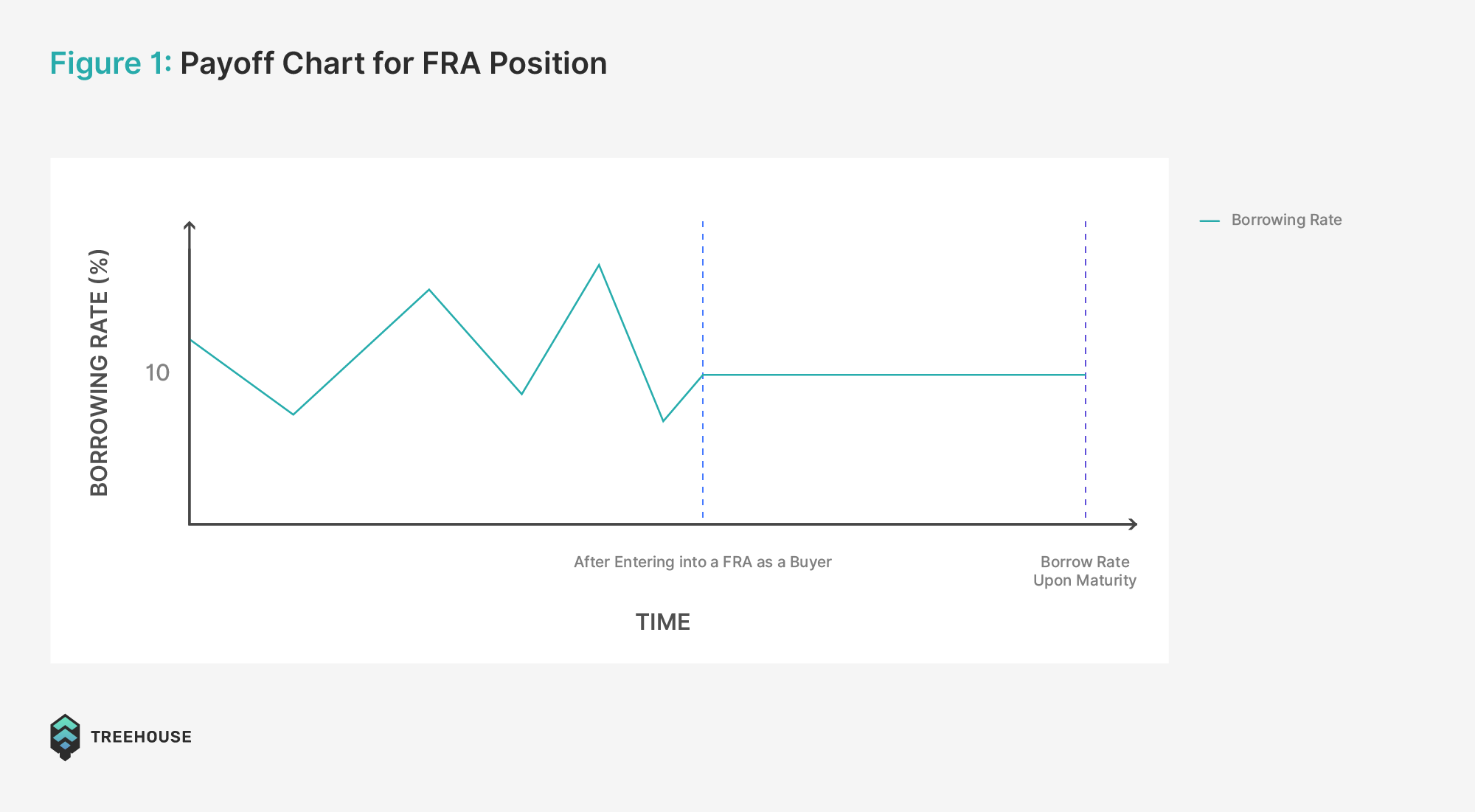

Imagine borrowing money from a loan shark with a serious mood swing problem. This guy doesn’t tell you the interest rate upfront—instead, he decides at the end of your loan term based on his mood. On a good day, he might charge a reasonable rate, but on a bad day? You could be hit with something way over 10%.

Now, you’ve only budgeted for a 10% interest rate, so the thought of him waking up grumpy on repayment day is stressing you out.

Enter your Treehouse Squirrel friends, who are, let’s say, very experienced gamblers. They offer you a deal:

- If the loan shark charges more than 10%, they’ll cover the extra interest.

- If it’s less than 10%, you’ll owe them the difference.

What happens if you take the deal? You’ve effectively locked in your rate at 10%!

In the end, your total cost stays the same—predictable, fixed, and safe from the whims of the grumpy loan shark.

A Deeper Dive: Long vs Short FRAs

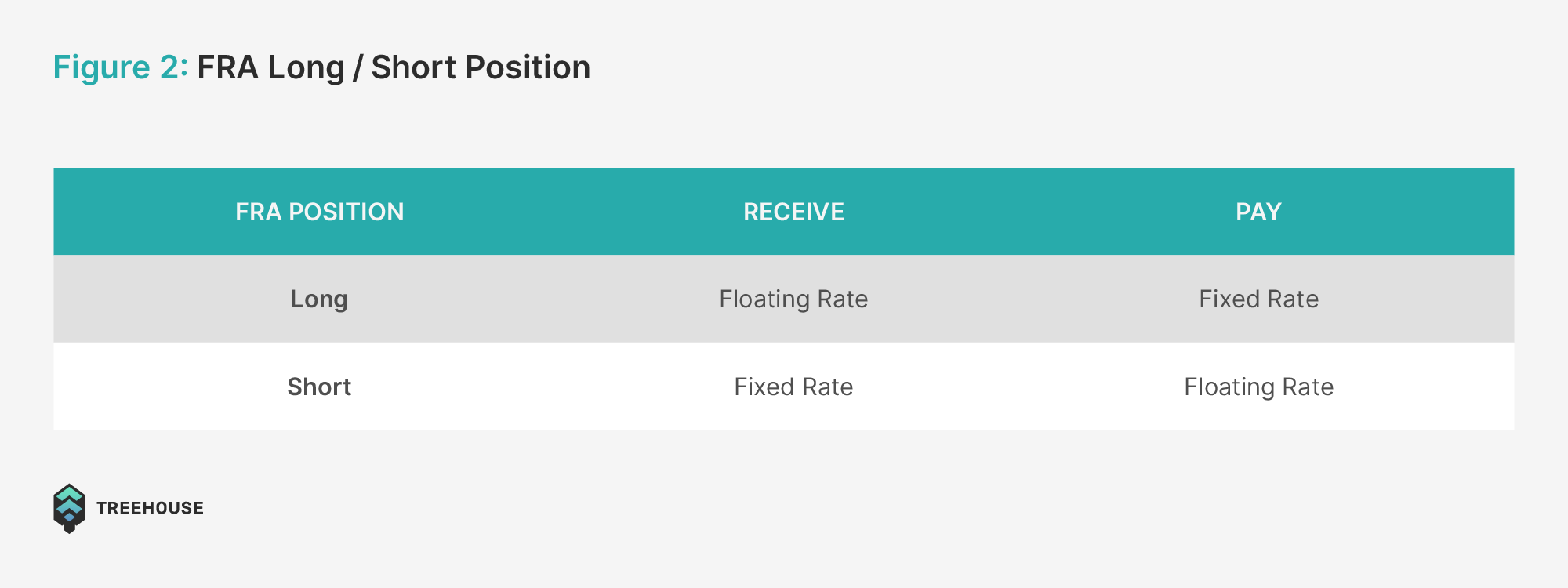

Forward Rate Agreements (FRAs) involve two key positions: Long (Buy) and Short (Sell):

- Long (Buy): You pay the fixed rate and receive the floating rate.

- Short (Sell): You pay the floating rate and receive the fixed rate.

Steps to Determining Your Position as a Borrower:

Let’s revisit the example where you are paying a floating rate to the loan shark but want to lock in a fixed rate.

- Identify what you’re paying:

- Are you paying a floating rate or a fixed rate?

- In this case, you are paying a floating rate.

- Identify how you want to manage your payment:

- Do you want to speculate on future rates or lock in predictability with a fixed rate?

- If you want to lock in a fixed rate, you need to offset your floating rate exposure.

- Match your position:

- To cover your floating payments, you need to receive a floating rate through an FRA.

- By entering a long FRA position, you effectively pay the fixed rate to the FRA counterparty while receiving the floating rate. This cancels out your floating rate exposure and ensures your net payment aligns with the fixed rate you desire.

2. FRAs from a Lender’s Perspective

Now imagine you’re the loan shark—perhaps a bit friendlier, but still in the business of making money. You’ve got some clever squirrel friends who are more than happy to act as counterparties for any FRA you want to try. Here’s what you, J Powell the loan shark, could do with FRAs:

Hedging:

- Locking in a Fixed Rate: Let’s say you want to guarantee a 12% fixed return, but your debtor is paying you a floating rate. To eliminate the uncertainty, you can short a FRA (enter as a seller).

- If the floating rate ends up below 12%, your gambler friends pay you the difference to make up for the shortfall.

- If the floating rate rises above 12%, you pay them the excess.

By shorting the FRA, you effectively lock in a 12% rate, regardless of how the debtor’s payments fluctuate.

- Switching to a Floating Rate: Now, let’s get a bit more creative. Suppose you’re receiving a fixed 5% from a debtor but decide you want to switch to a floating rate (because let’s be honest, fixed income is boring). Here’s what you do:

- Go long on a FRA (enter as a buyer).

- You pay your gambler friends the fixed 5% and receive the floating rate from them.

Voilà! You’ve transformed your predictable fixed income into an exciting (and potentially more lucrative) floating-rate stream.

Speculation:

- Of course, loan sharks love to take risks too. Imagine you’re still collecting a floating rate but feel confident you’ll scare people into paying more. You can enter into a FRA for speculation:

- If the floating rate falls below 12%, you pay the gambler the difference.

- If the floating rate rises above 12%, the gambler pays you the extra.

Now, here’s a quick test: Is this loan shark entering a long or short FRA position?

(Answer: Long FRA—he’s paying the fixed rate and receiving the floating rate.)

Steps to Determining Your Position as a Lender:

Revisiting the example where you are receiving a floating rate but want to lock in a fixed rate:

- Identify what you’re receiving:

- Are you currently receiving a floating or fixed rate?

- You are currently receiving a floating rate.

- Identify how you want to manage your interest inflow:

- Do you want to receive a fixed rate or speculate on rates?

- If you want to lock in receiving a fixed rate, you need to cover your floating inflow by paying a floating rate to the gambler.

- Match your position:

- Since you are receiving a floating rate and paying a floating rate to the gambler, both floating positions effectively net out.

The net position aligns with you receiving the fixed rate from the gambler, corresponding to a short FRA position.

You might be wondering, “Do I have to be a borrower or lender to get involved with a FRA?” The great news is—you don’t.

Just like your squirrel friends, anyone with a directional view on interest rates can participate by acting as the counterparty to either the borrower or lender. That said, success in FRAs relies heavily on thorough research and informed decision-making.

So, as always, DYOR (Do Your Own Research)!

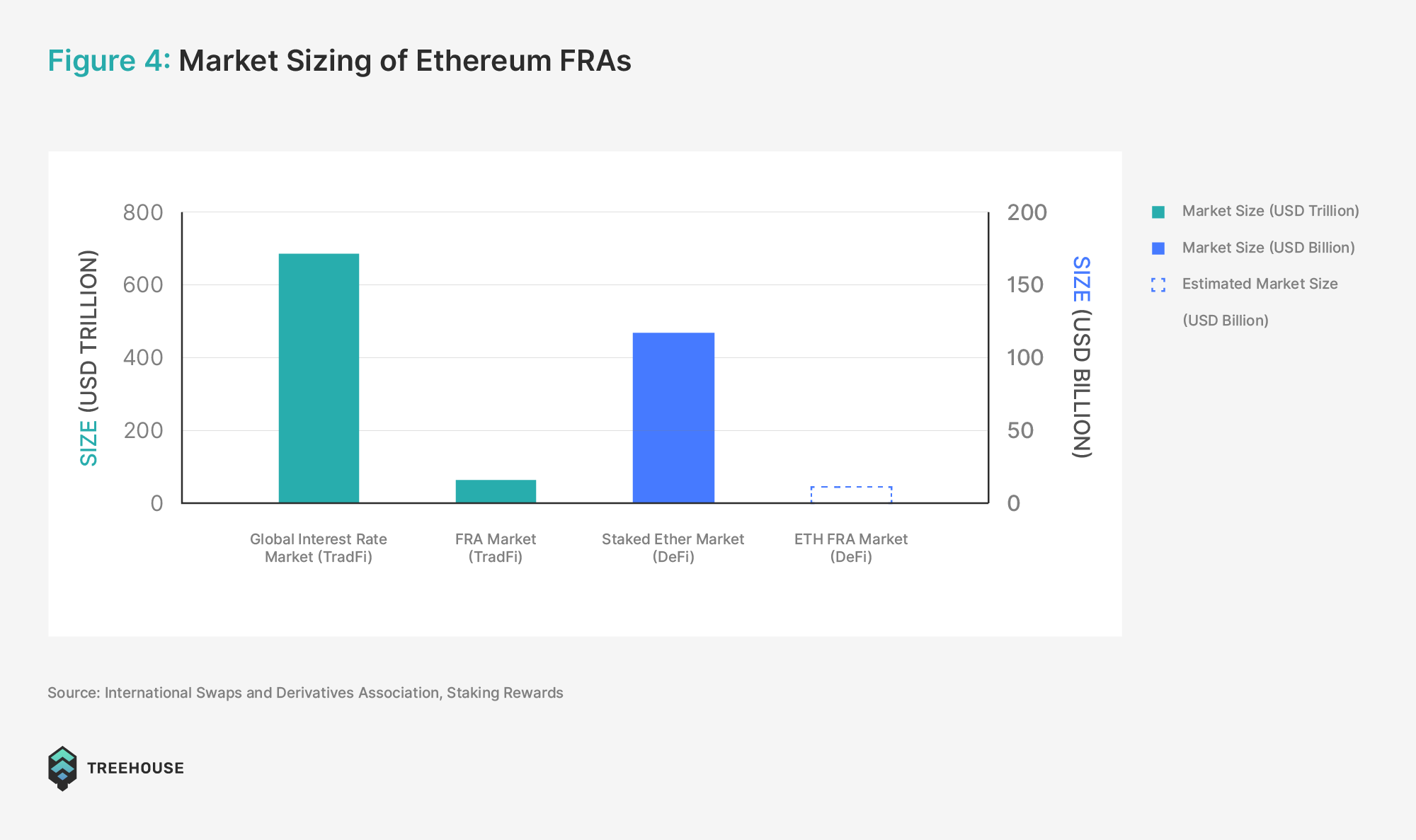

FRAs in TradFi

As of June 2024, the notional outstanding value of FRAs in TradFi over-the-counter markets stood at an astounding $62.8 trillion, representing approximately 10% of the global fixed-income market’s total notional outstanding amount of $687 trillion.

For comparison, equity derivatives lag far behind, with a notional value of around $8.7 trillion, just 13% of the FRA market size.

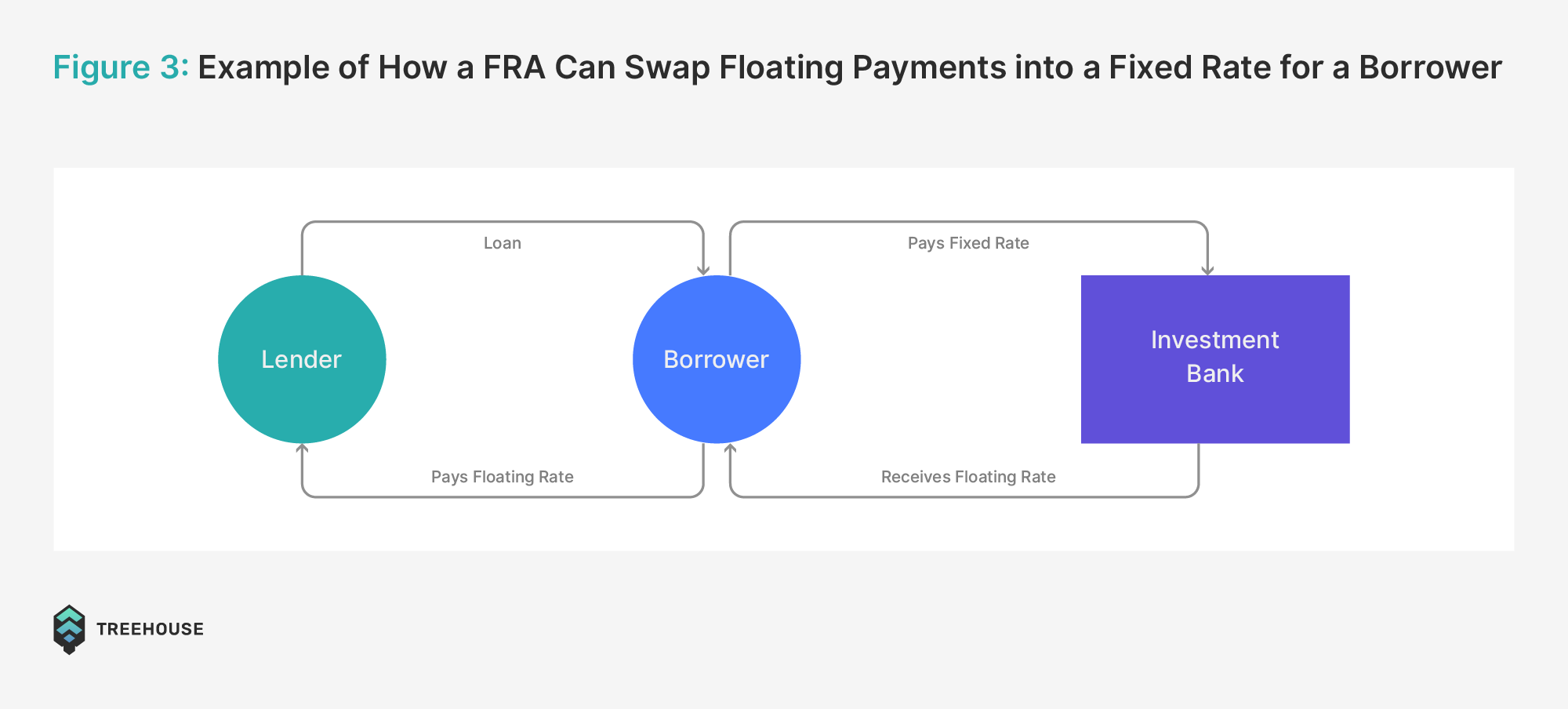

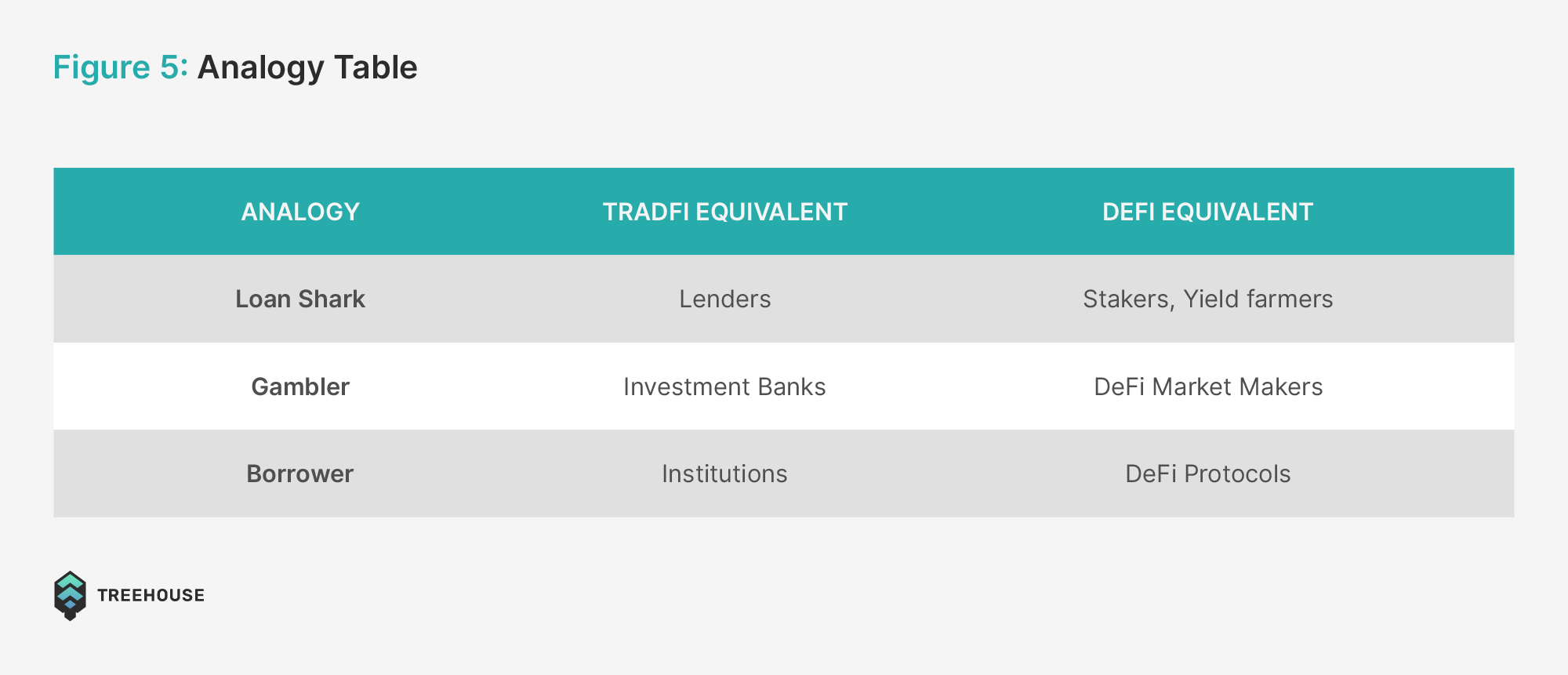

In TradFi, the ecosystem mirrors the below analogies we’ve used earlier:

- Lenders: such as Banks or financial institutions providing loans or credit.

- Squirrel friends: such as Investment banks that structure FRAs to manage interest rate risk.

- Borrowers: such as corporations, governments, or other entities requiring capital.

Instead of relying on the whims of mood swings, lenders and borrowers reference standardized benchmark rates like SOFR (Secured Overnight Financing Rate) to determine floating interest rates.

As you can see, FRAs in TradFi effectively manage interest rate risks, offering a benchmark to explore their potential application in DeFi.

FRAs in DeFi

But how can FRAs be effectively applied within the realm of DeFi?

The most obvious start? The staking rates of PoS chains!

For example, the Treehouse Ethereum Staking Rate (TESR) parallels interest rates in TradFi, offering a natural foundation for adapting FRAs to the DeFi ecosystem. Yet, the absence of FRAs in this space highlights a significant untapped market.

To illustrate the potential of this, approximately US $116 Billion worth of Ether is currently staked. Drawing a comparison to TradFi, where the FRA represents about 10% of the global fixed income size, capturing 10% of the staked Ethereum in an FRA market would represent a US $11 Billion opportunity.

From the DeFi perspective,

- Stakers represent Lenders, providing liquidity/decentralization to networks or protocols in exchange for staking rewards.

- Investment banks in TradFi are comparable to DeFi Market Makers, who actively provide markets as a service.

- DeFi Protocols and Networks are comparable to borrowers and rely on staking yields as a critical component of their operations.

With these stakeholders firmly established in Defi and DOR’s TESR nearing its launch, we now have the foundation to bring the FRA market to fruition.

What’s Next?

FRAs enhance the fixed income market by equipping participants with essential tools to manage interest rate risks. Beyond that, they lay the foundation for a broader range of fixed income products, such as interest rate swaps and options.

These advanced instruments will be the focus of our next initiative to establish a robust market for fixed income in DeFi.

Stay tuned for our upcoming blog, where we’ll explore these products in detail.

About Treehouse Protocol 🌳

Treehouse, the decentralized arm of the parent company Treehouse Labs, is at the forefront of revolutionizing the decentralized fixed income market. The Treehouse Protocol introduces innovative fixed income products and primitives, starting with tETH, a liquid re-staking token. tETH empowers its users to participate in the convergence of on-chain Ethereum interest rates while retaining the flexibility to engage in DeFi activities.

Treehouse Protocol is also pioneering the Decentralized Offered Rates (DOR) consensus mechanism for benchmark rate setting, enabling a range of fixed income products and primitives into digital assets. Treehouse is dedicated to creating safer and more predictable return alternatives for both individual investors and institutions.

- Website: treehouse.finance

- Discord: discord.gg/treehousefi

- X: x.com/TreehouseFi

- Docs: docs.treehouse.finance/protocol